New Construction vs. Fixer-Upper: What’s the Smarter Move in 2025?

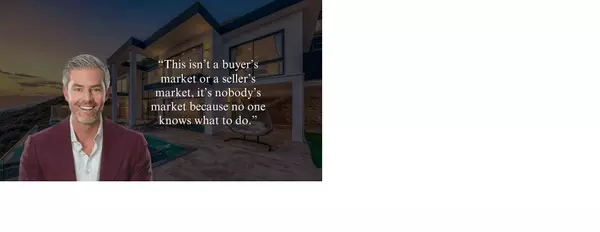

For the first time in years, existing homes (yes, the older ones that often need updates) are selling for more than brand-new construction. This significant shift in the real estate market has far-reaching implications for both first-time home buyers and seasoned investors who are considering buying a fixer-upper as a potential investment. The traditional wisdom that older homes are automatically more affordable is being challenged, forcing buyers to carefully reconsider their options in today's dynamic housing market.

According to the latest numbers, the median price of an existing home is $429,400. For a newly built home? $410,800.

That's an $18,600 difference - a gap that's causing many potential homebuyers to pause and reassess their assumptions about the relative costs of different types of properties.

So if you've been eyeing a resale home thinking it's the "cheaper" option, you might want to check out all your options, including move-in ready homes. Let's break down what's going on, why it matters, and what it means if you're thinking about buying a home in today's evolving real estate market, where new construction homes 2025 might actually offer better value than expected.

The Numbers Say It All

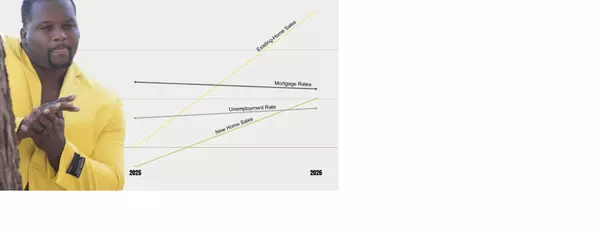

It used to be that brand-new homes were priced way above resales. From 2010 to 2019, the gap between new and existing homes averaged about $66,000. Over the past five years, that gap narrowed to around $25,000 on average, indicating a significant shift in market dynamics that's reshaping buyer opportunities and home values.

Things first flipped in Q2 and Q3 of 2024, when the median price of existing homes surpassed new homes for the first time - a trend that caught many real estate agents by surprise. And now in 2025, that trend is holding strong, despite fluctuations in mortgage rates and interest rates, suggesting this might be more than just a temporary market anomaly.

Not only are resale homes more expensive than new construction, but the direction nationwide pricing is also telling:

-

New home prices decreased 0.9% year-over-year, reflecting builders' efforts to maintain competitive pricing

-

Existing home prices increased 1.7% over the past year, driven by limited inventory and high demand

The Real Cost of a Fixer-Upper

Renovation projects aren't what they used to be, and buyers who jump into buying a fixer-upper thinking they'll save money could be in for a surprise. The reality of fixer upper costs in today's market can be shocking, especially for first-time buyers who might be underestimating the scope of work required. Before you start dreaming about sweat equity and DIY renovations, consider these critical factors:

-

Materials and labor costs are still elevated. Inflation may have cooled since the pandemic, but home renovation prices remain high. Lumber, roofing materials, and skilled labor all come at a premium. Current fixer upper costs can easily exceed initial budgets by 20-30% due to these elevated prices, impacting your overall fixer upper budget.

-

Contractor delays and backlogs continue to slow down projects. You might wait weeks (or months) just to get contractor estimates. This waiting period not only affects your renovation timeline but can also impact your financing and living arrangements. Many contractors are booked months in advance, potentially leaving you living in a construction zone longer than anticipated.

-

Unexpected repairs are almost guaranteed. From outdated electrical systems to mold behind walls, older homes often come with hidden costs that snowball fast. Structural repairs and foundation issues can quickly drain your budget. What might start as a simple kitchen remodel could uncover plumbing issues, asbestos, or other costly problems that must be addressed to meet current building codes. A thorough home inspection is crucial to uncover potential issues with HVAC systems and other critical components.

-

Time is money. Renovating takes time, and the costs extend beyond just materials and labor. For many buyers, the stress, delays, and additional carrying costs add up significantly. Consider mortgage payments, temporary housing costs if the home is uninhabitable during renovations, storage fees, and the potential loss of income if you're taking time off work to manage the project.

When comparing fixer upper costs to new construction homes 2025, it's essential to factor in these hidden expenses and potential complications. While the initial purchase price of a fixer-upper might seem attractive, the total investment required to make it livable and comfortable often approaches or exceeds the cost of a new construction home. This is particularly relevant for first-time buyers who might not have experience managing renovation projects or dealing with unexpected housing issues.

So while a fixer-upper might look more affordable up front, the reality is far more complex in today's market. When you meticulously calculate fixer upper costs, including escalating material costs, potential structural repairs, and the surprise expenses that inevitably emerge during renovation projects, you could find yourself investing significantly more than if you had opted for a new construction home. This financial revelation is particularly crucial for first-time home buyers who might be working with limited budgets and need to make every dollar count in their investment.

Why New Construction Is Suddenly the Better Deal

Builders are strategically positioning themselves in the current market, demonstrating remarkable adaptability and innovation that benefits potential homebuyers. Their approach to new construction homes 2025 reflects a deep understanding of buyer needs and market dynamics.

They're revolutionizing home design by constructing smaller, more efficient homes that maximize every square foot. These thoughtfully designed layouts eliminate wasted space while maintaining functionality, offering homeowners the perfect balance between comfort and practicality. The focus on efficiency extends beyond just layout - many new construction homes 2025 incorporate energy-saving features that translate to lower utility bills and long-term cost savings, potentially reducing maintenance costs and property taxes over time.

Builders are also making strategic location choices, identifying up-and-coming areas where land costs are more reasonable. This allows them to offer competitive pricing while still providing access to developing communities with promising growth potential. These locations often feature planned amenities, new infrastructure, and emerging commercial districts that can enhance property values over time.

Perhaps most significantly, builders are offering unprecedented buyer incentives that make new construction increasingly attractive. These incentives go beyond traditional offerings:

-

Interest rate buydowns that can significantly reduce monthly payments

-

Substantial closing cost assistance that helps buyers preserve their savings

-

Customizable design upgrades that would cost significantly more if done as after-market renovations

-

Smart home technology packages that enhance both comfort and security

-

Extended builder warranty that provides peace of mind and protection against future repair costs

Their ability to operate at scale gives builders unique advantages in managing costs. Through bulk purchasing power, established contractor relationships, and streamlined construction processes, they can maintain relatively stable pricing even in a volatile market. This efficiency explains why new home prices are showing signs of softening while resale prices continue their upward trajectory.

When a Fixer-Upper Might Still Be Worth It

While the market has shifted dramatically, there are still specific scenarios where investing in a fixer-upper makes strategic sense. These situations require careful evaluation of fixer upper costs and potential returns:

-

You've identified a property significantly below market value and have conducted thorough due diligence, including professional home inspections and detailed cost estimates for all necessary repairs and upgrades. Your calculations account for a substantial buffer to handle surprise expenses that typically arise during renovations.

-

You possess either the necessary renovation skills for DIY projects or have access to a reliable, affordable contractor network. Additionally, you have flexible living arrangements that allow you to manage an extended renovation timeline without incurring substantial temporary housing costs.

-

You're targeting a specific, established neighborhood where new construction simply isn't available. These areas often offer unique character, mature landscaping, and established community amenities that can't be replicated in new developments. However, be sure to factor in potential HOA fees and any restrictions on exterior renovations.

-

You have a specific vision for a custom remodel and want complete control over every aspect of the home's design and functionality. This approach might make sense if you have unique requirements or preferences that aren't typically available in standard new construction. Keep in mind that extensive interior renovations and cosmetic updates can quickly escalate your budget.

What This Means for You

The shifting dynamics between fixer-uppers and new construction demand a thorough reevaluation of traditional home-buying assumptions. The notion that "older equals cheaper" has become outdated, particularly when considering the comprehensive cost of bringing an older home up to modern standards.

When factoring in renovation expenses, energy efficiency upgrades, and the potential for costly structural repairs, you might find yourself investing more in a fixer-upper than you would in a new construction home that comes with modern amenities, updated systems, and comprehensive warranties. Additionally, consider the long-term implications on homeowners insurance, which may be higher for older homes with outdated systems.

This market reality is particularly significant for first-time home buyers who are navigating various financing options while trying to maximize their investment. The predictability of costs associated with new construction can make budgeting and financial planning more straightforward compared to the often unpredictable nature of renovation projects.

Before making a decision, consider these essential steps in your home buying process:

-

Develop a comprehensive budget that accounts for all potential renovation costs, including materials, labor, permits, and a substantial contingency fund for unexpected issues.

-

Research and evaluate builder incentives thoroughly, comparing them with the total cost of purchasing and renovating an older home. Don't forget to factor in potential equity growth and appreciation potential for both options.

-

Assess your personal circumstances, including your timeline, living situation during potential renovations, and long-term goals for the property.

-

Partner with experienced real estate agents who can provide detailed insights into local market trends and accurate renovation cost estimates for your area. They can also guide you through the complexities of the home buying process, whether you're considering a fixer-upper or new construction.

The current real estate market offers unique opportunities in both the resale and new construction sectors. Whether you're leaning toward buying a fixer-upper or a move-in ready home, success lies in understanding all available options and making an informed decision based on your specific circumstances and goals. Remember to consider factors like property taxes, maintenance costs, and potential resale value as you navigate your home search in this evolving housing market.

Categories

Recent Posts

GET MORE INFORMATION

Real Estate Agent | License ID: 0793329