Why Saving for a Home Feels Hard (and How to Fix It)

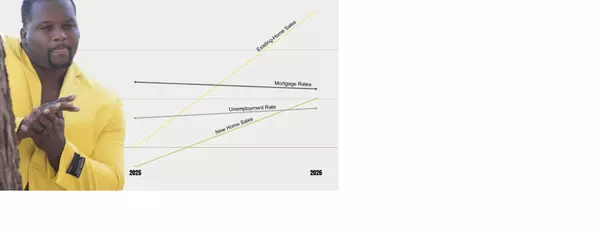

Saving for a home doesn't mean putting your entire life on pause. You still want to celebrate your friends' milestones, take the occasional vacation, and enjoy your weekends. But without a plan, those "one-off" expenses can quietly eat into your down payment savings. This is especially challenging in today's economic climate, where the cost of living and rental prices continue to rise, and fluctuating interest rates add another layer of complexity to the homebuying process.

Take wedding season as an example: between travel, gifts, outfits, and pre-wedding festivities, the cost of attending just one wedding, plus a bachelor or bachelorette weekend, costs an average of $2,016.

That's pretty close to the typical monthly rent of $2,072. When you stack two or three weddings in one summer, and add in birthdays, holiday spending, and spur-of-the-moment events, it's no wonder it feels impossible to save.

The truth is, you don't need to say no to every invitation or skip every luxury coffee. You just need a strategy that helps you spend intentionally, save consistently, and keep your homeownership goals front and center. This is especially important for first-time homebuyers who are navigating the complex world of mortgages and loan options, including understanding various mortgage terms like fixed-rate mortgages and how they affect the overall purchase price of a home.

Why Saving Feels So Hard Right Now

We're living in a time of high rent, rising home prices, and inflation that makes everything from groceries to gas more expensive. Without a clear system, it's easy to:

-

Dip into savings for "just one" celebration or event

-

Let subscriptions and small expenses pile up

-

Delay putting money aside because the target feels too big

-

Fall into the trap of impulse spending, derailing your savings plan

And renters feel that financial strain. A recent survey found that:

-

45% reported making a housing sacrifice to afford wedding celebrations.

-

15% opted for a smaller rental or starter home, and 11% chose to live with roommates.

-

25% said they've turned down at least one event because the cost was just too high.

The good news is that a few intentional changes can make your savings feel achievable again, even in the face of rising rental prices and a high cost of living. By learning to budget effectively and setting clear savings milestones, you can make steady progress towards your homeownership goals. This might include exploring suburban areas for more affordable housing options or considering alternative approaches like rent-to-own agreements.

7 Money Habits to Start Today

Here are simple strategies I recommend to renters and future buyers:

1. Set Your Budget

Before you say "yes" to any trip or invitation, you need to know what you can actually afford.

Set a realistic rent budget. You can do this with the 50/30/20 budgeting rule: 50% for needs (like housing), 30% for wants (including weddings), and 20% for savings or debt repayment. This 50/30/20 rule helps you balance your essential expenses, discretionary spending, and financial goals, allowing you to budget effectively while still enjoying life. It's a great way to stay within your financial comfort zone while working towards your homeownership dreams.

2. Lock in Your Housing Savings

Treat your down payment savings or housing savings like a non-negotiable bill. Automate transfers into a separate high-yield savings account every payday so you're paying yourself first. This approach ensures consistent progress towards your home buying goals and helps you reach important savings milestones along the way. Consider exploring certificates of deposit for potentially higher returns on your long-term savings.

3. Build an Emergency Fund or "Whoops Fund"

Start small and build on it to provide a cushion for unexpected costs. Using a round-up tool like Acorns can make it easier to save money. If possible, keep the funds in a high-yield savings account or consider money market accounts for potentially better returns. This fund can also help you avoid dipping into your home savings for emergencies. Embrace micro-saving techniques to consistently grow your emergency fund without feeling the pinch.

4. Lower Your Monthly Bills

A record 36% of rentals offered concessions in July, including free rent or free parking. If you are moving or your current lease is coming up, ask about these incentives to free up money for other priorities.

If that's not an option, start looking at other monthly expenses, including utilities, water, phone and internet. Call each provider to learn about your options to lower these bills. Even small adjustments, like canceling unused subscriptions or cooking at home more often, add up. This can help improve your debt-to-income ratio, which is crucial when applying for a mortgage, especially a fixed-rate mortgage. Additionally, focus on paying down any high-interest debt and credit card balances, as this can significantly impact your ability to save and qualify for better mortgage terms.

5. Choose Events Intentionally

You don't have to skip every celebration, but prioritize what matters most.

You can also get creative with the events you do attend. Sharing costs or attending only part of an event can save you hundreds of dollars without skipping celebrations. Remember, every dollar saved can go towards your down payment or closing costs, bringing you closer to your savings milestones. Consider implementing the 24-hour rule for non-essential purchases to avoid impulse spending on events or items you don't truly value.

6. Automate Your Bills and Savings

Set up autopay for recurring expenses and automatic savings contributions. The less you rely on willpower, the easier it is to hit your goals. Consider using direct deposit splits to automatically divert a portion of your paycheck into your savings account. This strategy can help you avoid impulse spending and stay on track with your savings goals. If you receive performance bonuses at work, consider automatically saving a portion of these windfalls for your home fund.

7. Consider All Your Options to Homeownership

A lot of people still believe that you need a 20% down payment to buy a home. But there are plenty of loan options and incentives designed to make homeownership more accessible, with some offering down payments as low as 0-3%.

For first-time homebuyers, it's essential to explore various loan programs such as FHA loans backed by the Federal Housing Administration, VA loans for service members and qualifying spouses, and USDA loans for rural areas backed by the Department of Agriculture. Each of these options has different requirements and benefits, potentially increasing your buying power. Additionally, look into conventional loans, which are often backed by Fannie Mae or Freddie Mac and adhere to conforming loan standards, and jumbo loans for higher-priced homes that exceed conforming loan limits.

Be sure to talk with a real estate professional to learn about all the available options in Dallas-Fort Worth. They can guide you through the pre-approval process and help you understand how different loan options, including fixed-rate mortgages, affect your monthly mortgage payments. Don't forget to ask about private mortgage insurance (PMI), which may be required for down payments less than 20%, and how it impacts your overall costs. Also, inquire about income limits for various loan programs to ensure you qualify.

The Big Picture

Buying a home is one of the most rewarding milestones you can reach, but it doesn't happen by accident. With the right plan, you can celebrate life's biggest moments and still stay on track to own your dream home in Dallas-Fort Worth. Consider adopting a hybrid approach that balances saving with living your life to the fullest.

Remember, every small step counts. Whether it's setting up automatic transfers to your savings account, exploring side hustles to boost your income, or simply being more mindful of your spending, these actions all contribute to your homeownership goal. Side hustles like dog walking, pet sitting, house cleaning, freelance work, or selling handmade goods on online marketplaces can provide extra income to accelerate your savings. You might even consider joining delivery services for flexible earning opportunities.

By understanding your finances, exploring all available loan options, and staying committed to your savings plan, you'll be well on your way to turning your homeownership dream into reality. Don't forget to take advantage of homebuyer education courses, which can provide valuable insights into the home buying process, help you understand complex mortgage terms like fixed-rate mortgages, and potentially unlock additional benefits or assistance programs.

For those looking at alternative paths to homeownership, consider options like co-buying with friends or family members, where you can share ownership stakes and split costs. This approach can make entering the housing market more accessible, especially in competitive areas. Additionally, look into state housing finance agencies and development authorities, such as Texas Department of Housing and Community Affairs, which often offer programs and resources for first-time homebuyers.

Stay focused, be patient, and keep your eye on the prize. Your future home in Dallas-Fort Worth is waiting for you!

Sources: Zillow, NerdWallet, Lafayette FCU, RentCafe, BAM

Categories

Recent Posts

GET MORE INFORMATION

Real Estate Agent | License ID: 0793329