Unlocking the Power of Home Equity: A Comprehensive Guide

Home equity is one of the most overlooked sources of financial stability. With national data showing that 40.3% of U.S. homeowners now own their homes mortgage-free, many people are realizing they may be sitting on more equity than they think. This rising trend in mortgage-free ownership provides insight into the wealth that longtime homeowners have built over the years.

It also offers a helpful benchmark for understanding where you might stand today, even if you still have a mortgage. Whether you're considering a home equity loan, a Home Equity Line of Credit (HELOC), or simply want to understand your financial position better, this guide will help you navigate the world of home equity and explore options like equity lines and heloc loans.

What "Home Equity" Really Means (In Plain English)

Home equity is simply the difference between what your home is worth today and what you still owe on it. For example, if your home could sell for $600,000 and your remaining mortgage balance is $200,000, you have $400,000 in equity. Lenders often use a loan to value ratio to determine how much you can borrow against your equity.

This equity doesn't appear all at once. It builds gradually and predictably. As home values rise over time and each mortgage payment reduces your loan balance, the gap between those two numbers grows. When you own a home for a long stretch—especially if you refinanced into a lower rate years ago—these effects compound.

This is why homeowners who bought years ago often have more equity than they think. The growth happens in the background, and many people don't realize how significant it has become until they take a closer look using a home value estimator or home equity calculator.

The Rise in Mortgage-Free Homeownership

The newest analysis, based on U.S. Census Bureau data, shows just how much equity has grown across the country. These numbers give every homeowner a starting point for comparison:

-

40.3% of U.S. homeowners now own their homes mortgage-free

-

Up from 39.8% in 2023

-

Up from 32.8% in 2010

One major reason equity levels are so high today is simple: time.

The U.S. homeowner population is getting older, and many people who bought homes 20 to 30 years ago have either paid off their mortgages completely or are very close to doing so. As homeowners stay in their properties longer, full payoff becomes more common.

Among homeowners age 65 and older, nearly two-thirds now own their homes outright. That's a meaningful shift compared to previous decades, and a key reason the share of mortgage-free homeowners keeps climbing nationwide.

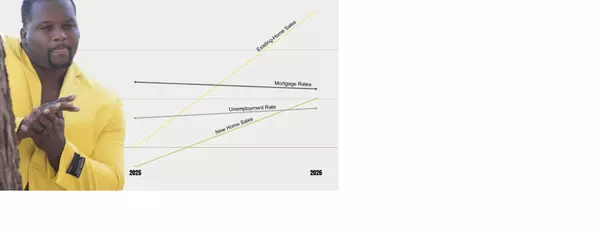

What This Means for the Market (And for You)

When a large portion of homeowners have little or no mortgage debt, the market behaves differently. Fewer people are forced to sell due to financial pressure. Sellers can afford to be more patient with pricing and timing. And overall, the market tends to be more stable, with fewer distress-driven transactions.

For individual homeowners, this stability creates something just as important: options. Equity isn't just a number on paper. It's flexibility, and the ability to make housing decisions on your terms, not because of urgency. This is where home equity products like home equity loans and HELOCs come into play, offering competitive rates and flexible borrowing options.

Common Ways Homeowners Use Their Equity

Every homeowner's situation is different, but once people understand how much equity they've built, many begin exploring similar options. Importantly, selling the home is just one path—not the default.

Homeowners commonly use their equity to:

-

Downsize to reduce upkeep and free up cash

-

Purchase another property while keeping their current home

-

Renovate or update their home instead of moving

-

Make aging-in-place upgrades, such as accessibility or safety improvements

-

Help family members with housing or major life expenses

-

Stay put, knowing they're financially secure and not under pressure to move

Others take a more planning-focused approach and use equity as a decision-making tool rather than an immediate action. That can include:

-

Requesting a personalized equity review to understand where they stand

-

Exploring options like a home equity loan or HELOC for improvements or debt consolidation

-

Reviewing long-term financial or tax considerations with a trusted professional

The key takeaway is simple: owning a home outright—or having significant equity—doesn't mean you're finished thinking about your housing strategy. It means you have more choices, and the ability to make decisions that support both your lifestyle and long-term financial stability.

Understanding Home Equity Products

When it comes to accessing your home equity, there are several options available:

-

Home Equity Loan: This is a lump-sum loan that uses your home as collateral. It typically comes with a fixed rate and fixed monthly payments over a set term.

-

Home Equity Line of Credit (HELOC): A HELOC is a revolving credit line that allows you to borrow against your equity as needed. It usually comes with a variable rate tied to the prime rate, though some lenders offer fixed-rate options. HELOCs often feature low rates and interest-only payments during the draw period.

-

Cash-Out Refinance: This involves a mortgage refinance for more than you owe and taking the difference in cash. It can be a good option if current rates are lower than your existing mortgage rate.

Each of these options has its own set of pros and cons, including different loan terms, closing costs, and interest rates. It's important to compare heloc rates and understand the loan terms before making a decision.

How to Use a HELOC

A Home Equity Line of Credit (HELOC) is a flexible way to access your home equity. Here's how it typically works:

-

You're approved for a credit limit based on your home's value and your equity.

-

You can draw from this line of credit as needed during the draw period (usually 5-10 years).

-

You only pay interest on the amount you borrow, often with the option for interest-only payments.

-

After the draw period, you enter the repayment period where you pay back the principal and interest.

HELOCs often come with variable rates, which means your monthly payment can change based on market conditions and the prime rate. However, some lenders offer fixed-rate options for more predictable payments. To get a HELOC, you'll need to meet certain criteria, including a good credit history and sufficient equity in your home.

A Quick Reality Check: Why Many Homeowners Underestimate Their Equity

Despite rising equity levels nationwide, many homeowners still underestimate how much equity they actually have.

Often, it's because they haven't checked their home's value recently. Others still think in terms of what they paid for the home years ago. And many assume that market changes don't really affect their specific neighborhood.

In reality, local market shifts can quietly add (or subtract) tens or even hundreds of thousands of dollars in value over time. Without looking at updated, local data or using a home value estimator, it's easy to miss just how much has changed.

A Simple Next Step

You don't need to be planning a sale to understand your equity. Knowing where you stand helps you make informed decisions, plan ahead without pressure, and understand your options before you ever need them.

If you're curious about how much equity you may have, and what it could mean for your future, consider these steps:

-

Use an online home equity calculator to get a rough estimate of your available credit.

-

Research today's rates for home equity products and HELOC rates in your area.

-

Consult with a financial advisor or lending specialist to discuss your home equity options.

-

If you're considering a home equity loan or HELOC, compare offers from multiple lenders to find the best terms and rates. Look for features like low rates, no annual fee, and convenient online banking or mobile banking options.

Remember, understanding your home equity isn't just about accessing cash—it's about making informed decisions for your financial future. Whether you're looking to fund home improvements, consolidate debt, or simply want to know your options, your home equity can be a powerful financial tool.

Sometimes, knowing what you already have is the smartest move you can make. Take the time to understand your home equity position, and you'll be better equipped to make decisions that align with your long-term financial goals. With options like online applications and secure application processes, getting started with a HELOC or home equity loan has never been easier.

Sources: Fast Company, BAM, ResiClub

Categories

Recent Posts

GET MORE INFORMATION

Real Estate Agent | License ID: 0793329