Mortgage Rates Hit an 11-Month Low: Here's What That Means for Your Buying Power

Imagine saving $150 a month on the same home, just because mortgage rates dropped. That's exactly what's happening now, thanks to mortgage rates falling to their lowest point in 11 months. This drop means homebuyers in Dallas-Fort Worth have more purchasing power today than they've had in nearly a year, especially beneficial for first-time home buyers.

Let's dive in.

What Happens When Mortgage Rates Fall?

Mortgage rates work like a price tag on your loan. When rates are high, borrowing costs more each month. When rates fall, even by a small percentage, your monthly payment shrinks. These market fluctuations can significantly impact the housing market conditions.

That lower payment means one of two things:

-

You spend less each month for the same home.

-

You buy more home for the same monthly budget.

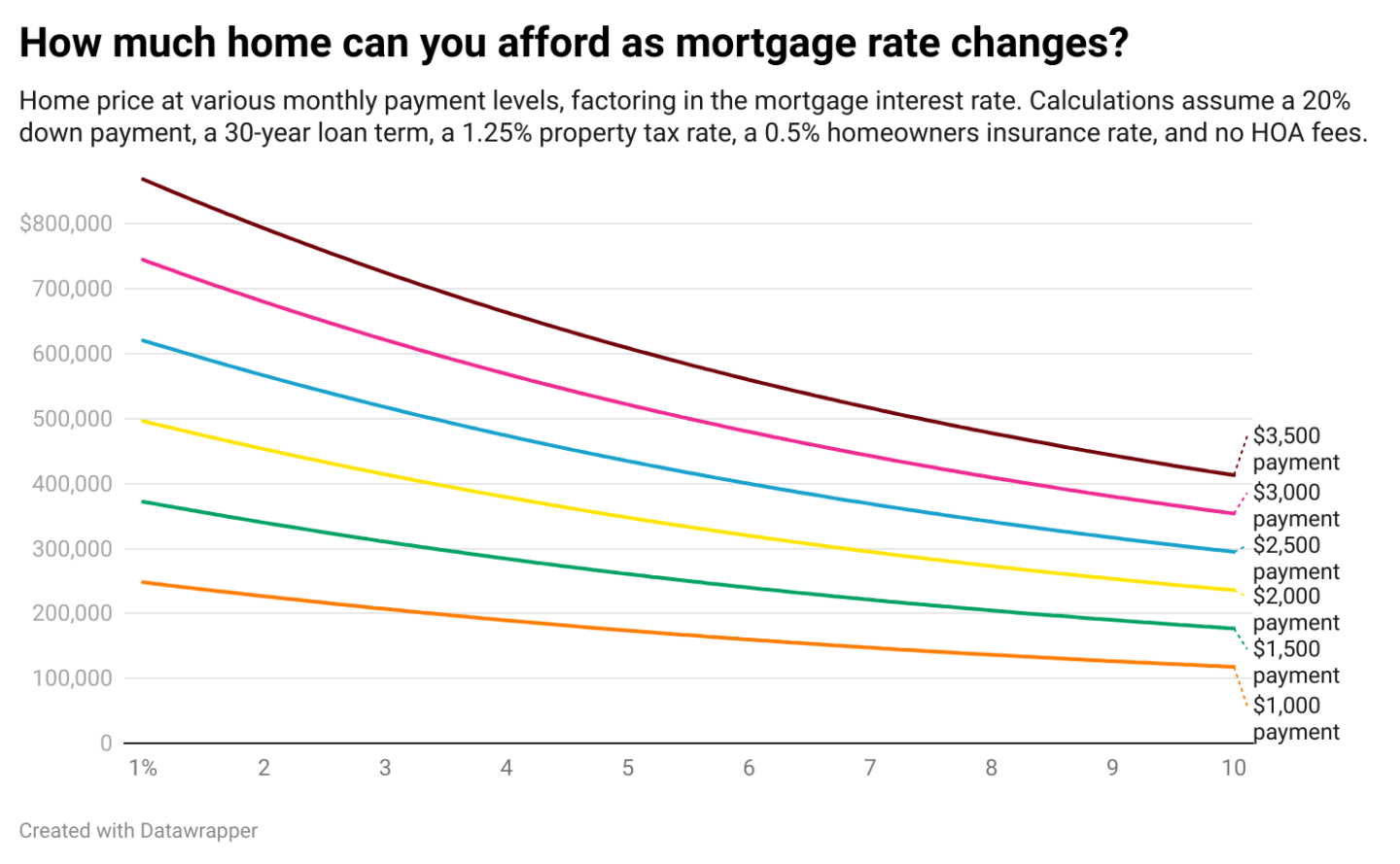

How Much Home Can You Afford?

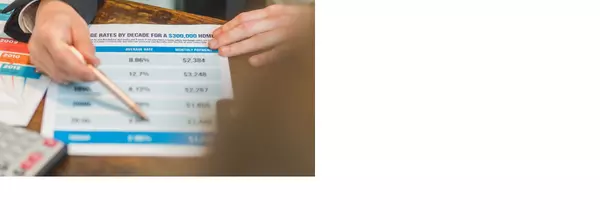

Let's look at an example of a buyer with a $3,000 monthly housing budget, considering the recent changes in the Texas housing market.

In June, when rates averaged 6.9% a buyer could afford about $446,000, assuming a 20% down payment on a 30-year fixed mortgage.

A couple of weeks ago, when rates were closer to 6.5%, that same buyer could afford a $460,500 home.

And now that rates have a new 2025 low of 6.27%? That buyer can afford a home worth $468,000.

In other words, buyers have gained $7,500 in purchasing power in the past week alone and a total of $22,000 in just three months. This increase in affordability could potentially lead to increased buyer demand.

Monthly Savings Add Up Fast

Here's another way to look at this:

The median home prices in the U.S. are about $444,000. In June, the monthly mortgage payment would have been about $2,624 for a median-priced home.

Today, as mortgage rates fell, the monthly mortgage payment for that home comes in at $2,481—a savings of roughly $150 every month. Over the life of a loan, that's tens of thousands of dollars saved.

Now, let's look at an example here in Dallas-Fort Worth where the median home sales price is currently $363,000.

Let's look at the math, assuming a 20% down payment:

-

Monthly payment for a median-priced home in Dallas-Fort Worth at 6.29%: $2,824

-

Monthly payment at 6.5%: $2,864

-

Monthly Payment at 6.9%: $2,941

-

Monthly savings since June: $117

Those monthly savings on housing could help in a number of ways:

-

Building a "rainy day fund"

-

Paying off higher-interest debt more quickly

-

Investing for retirement

-

Saving for a vacation or a bucket list adventure

-

Saving for holiday spending (gifts, travel, decorating)

For those considering FHA loans, these savings could make homeownership even more accessible.

Is This Your Window?

Mortgage rates don't typically fall this low without good reason. Recent economic indicators have shifted the outlook, and buyers are in a unique position. Various economic factors contribute to these changes in borrowing costs.

Lower rates don't just improve affordability; they also create new opportunities in the housing market. The current housing supply, combined with these favorable rates, could create an ideal scenario for potential homebuyers.

As we observe these housing market conditions, it's important to note that the housing market cycle is always in flux. Days on market may decrease, and we might even see a return of bidding wars or homes selling above asking price if buyer demand increases significantly.

For those considering long-term ownership, this could be an opportune time to enter the market. However, potential buyers should also factor in other considerations such as loan eligibility and closing costs when making their decision.

Remember, while current market conditions are favorable, they can change. A rate lock agreement might be worth considering if you're in the process of buying a home.

In conclusion, as mortgage rates continue to fall, the landscape for homebuyers is improving. Whether you're a first-time buyer or looking to upgrade, now might be the time to take advantage of these market conditions.

Curious about how much home you can afford? Run payment scenarios through our mortgage calculator or reach out for a more detailed breakdown!

Sources: Redfin, Mortgage News Daily

Categories

Recent Posts

GET MORE INFORMATION

Real Estate Agent | License ID: 0793329