Downsizing in 2025? A Step-by-Step Guide to Selling for Top Dollar

If you've owned your home for more than a few years, chances are you're sitting on a significant amount of equity, and possibly wondering if now's the time to consider home downsizing. According to a recent Realtor.com analysis, baby boomers—those born between 1946 and 1964—own an estimated $18 to $19 trillion worth of real estate. That's nearly half of the housing wealth in the U.S.

Whether your kids are out of the house, you're retiring, or just want less maintenance, selling your longtime home can unlock major financial and lifestyle opportunities. But downsizing your home also comes with questions:

-

Where will you go next?

-

How do you maximize your return?

-

What steps should you take before listing?

Here's a complete guide to help you move forward with clarity, confidence, and a plan that preserves your wealth as you navigate the process of downsizing for retirement.

Step 1: Understand Your Equity Position

You probably already know your home's value has gone up. But do you know by how much?

Your equity is the difference between your home's market value and what you still owe on your mortgage. Take a moment to look at recent sales in your neighborhood or talk to a real estate agent for a comparative market analysis. Subtract anything you still owe on your mortgage to get an understanding of how much equity you have.

For most longtime owners, it's a big number. That's your opportunity when downsizing your house.

Step 2: Talk to a Financial or Tax Advisor

Here's the good news: if you've lived in your home for at least two of the past five years, you can likely exclude up to $500,000 in capital gains (if you're married) or $250,000 as an individual when you sell.

Still, before you make any big moves, chat with a financial advisor or tax pro. They can help you with retirement planning and financial planning, including how to:

-

Minimize taxes and understand tax implications

-

Strategically reinvest your proceeds

-

Set up the next chapter without stress

This step can save you a lot of headaches later and help you align your downsizing decision with your long-term financial goals.

Step 3: Think Through the Emotional Side

This isn't just a house. It's where you raised your kids, hosted holidays, and built a life. Selling it is a big deal, especially when downsizing in retirement.

Talk it through before making any final decisions. Reminisce. Take your time.

Then shift the focus to what's ahead: more freedom, fewer responsibilities, and maybe even a fresh start in a new spot. Consider the lifestyle changes that come with downsizing your home and how they align with your ideal retirement lifestyle.

Now Let's Talk About Selling for Top Dollar

Once you've made the decision to downsize your home, it's time to get your house ready for the market. And this is where preparation is essential.

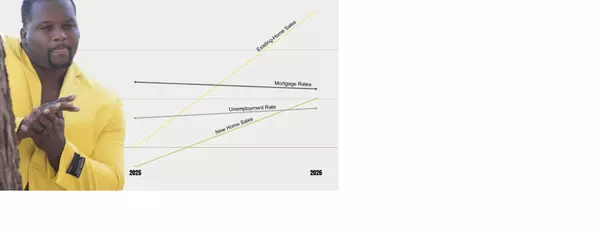

Here's how to maximize your sale without spending a fortune, considering current housing market trends.

Step 4: Declutter and Simplify

Once the decision is made, it's time to get your home ready. And that starts with the crucial step to declutter your home.

Buyers want to visualize themselves in your space. So take it room by room and get rid of anything you won't take with you. Donate it, sell it, or toss it.

And no, shoving it all into closets doesn't count. Buyers will open those.

This not only improves how your home shows, it also makes your move easier and helps you adapt to a more streamlined lifestyle.

Step 5: Deep Clean and Make Small Updates

You don't need a full renovation. But clean, well-maintained homes sell faster and for more money in the current real estate market. Focus on:

-

Scrub appliances and bathrooms

-

Wash windows

-

Wipe baseboards

-

Clean grout and caulking

-

Updated light fixtures and cabinet hardware

-

Polish floors or new carpet where needed

-

Fresh paint in neutral tones

These are easy wins that make a big difference and can potentially lower future utility costs for buyers.

Step 6: Stage Your Home Like a Pro

Staging isn't decorating. It's strategic styling to highlight your home's best features. Some tips:

-

Use neutral, modern furniture to maximize space

-

Add light with lamps, mirrors, and open curtains

-

Highlight key rooms like the living room, kitchen, and primary bedroom

Even partial staging or a professional consultation can significantly boost buyer interest and help your home stand out in the competitive real estate market.

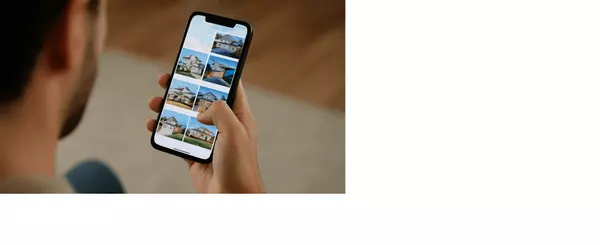

Step 7: Maximize Screen Appeal

In today's digital age, your online listing is your first showing. That means the home must photograph well.

Before the shoot:

-

Hide cords, trash cans, towels, and personal items

-

Open blinds for natural light

-

Clear countertops and tables

-

Remove rugs to show off floors

Work with your real estate agent to ensure high-quality, professional photography. Buyers scroll fast, and first impressions matter more than ever in the current housing market.

Step 8: Define Your Next Chapter

Selling is just one piece of the puzzle. Where you go next, and what that lifestyle looks like, is equally important.

Whether you're relocating, buying a smaller home, or renting while you explore options, get clear on your next move and timeline before you list. Consider factors like property taxes, cost of living, and potential retirement communities in your desired locations.

Final Thought

Selling your family home and downsizing for retirement is a major life transition. But it can also be the gateway to a simpler, more flexible, and financially secure lifestyle.

You've built up equity. You've taken care of your home. You're ready for the next chapter.

Now it's time to make sure you're set up to walk away with the strongest possible sale. By understanding market conditions, working with a knowledgeable real estate agent, and carefully considering your retirement income and savings, you can make the most of this opportunity to downsize your home and set yourself up for a comfortable retirement.

Categories

Recent Posts

GET MORE INFORMATION

Real Estate Agent | License ID: 0793329